Heartwarming Info About How To Lower Interest Rates On Car Loans

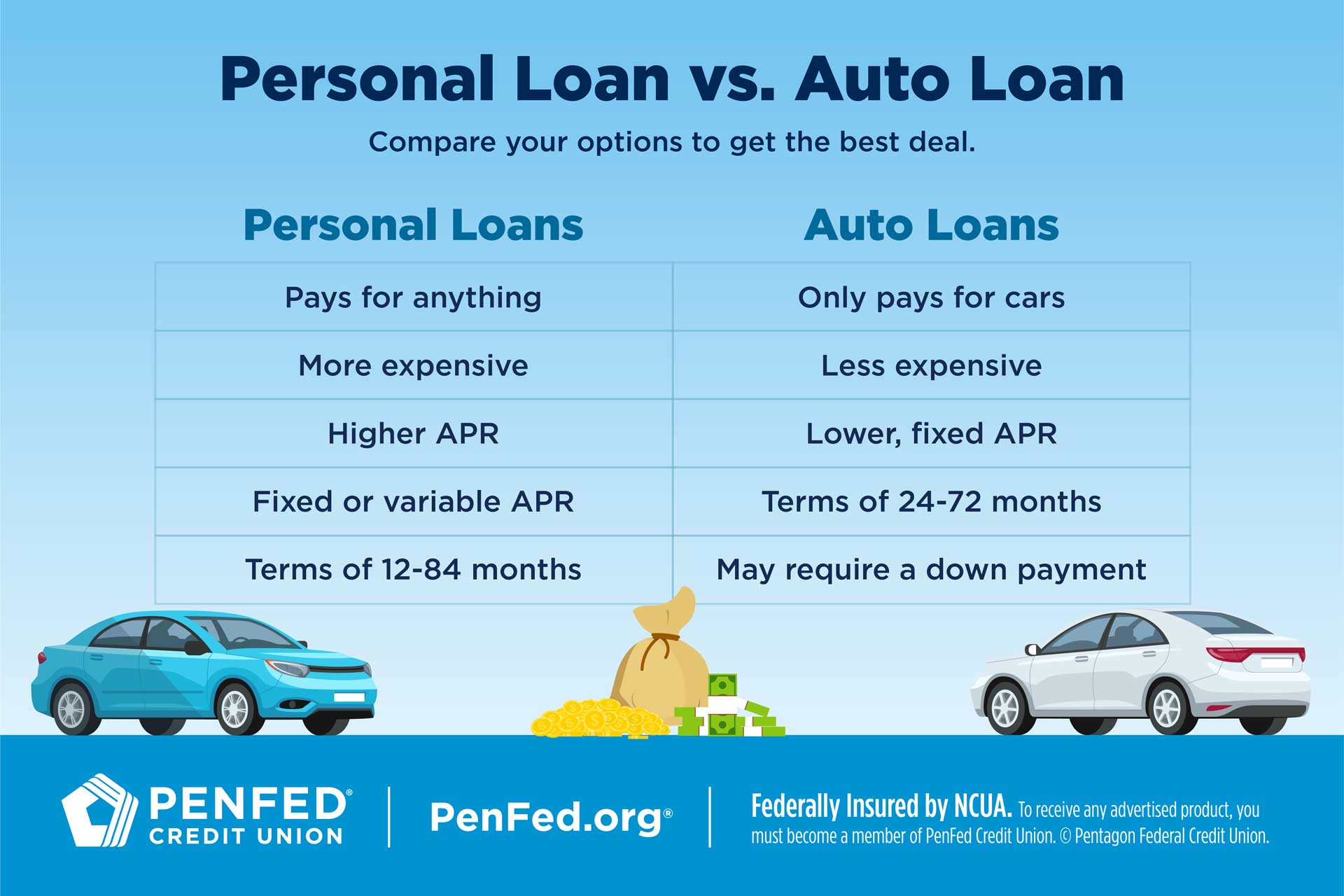

Here are a few things you can do to lower your car loan interest rate:

How to lower interest rates on car loans. It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto. Be sure to compare the financing offered through the dealership with the rate and terms of any preapproval you received from a. On that same $300,000 loan, a rate of.

With more affordable interest rates, your. Ask or negotiate for a loan with better terms. Ad low interest rates car loan | online reviews | fast approval | apply fast&easy!

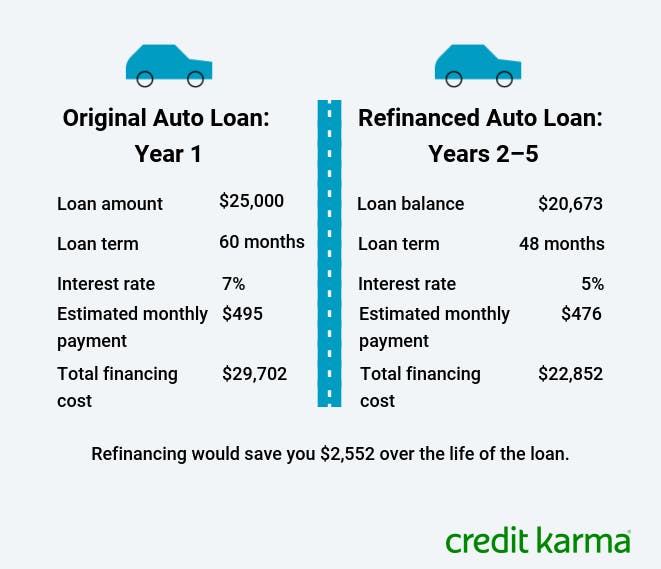

On a $300,000 loan, a rate of 3.11% results in a monthly payment of about $1,283, jacob channel, senior economist at lendingtree, said. Nov 16, 2018 — how to lower. Refinance your car loan if you already have a car loan, you could secure a lower apr by refinancing the.

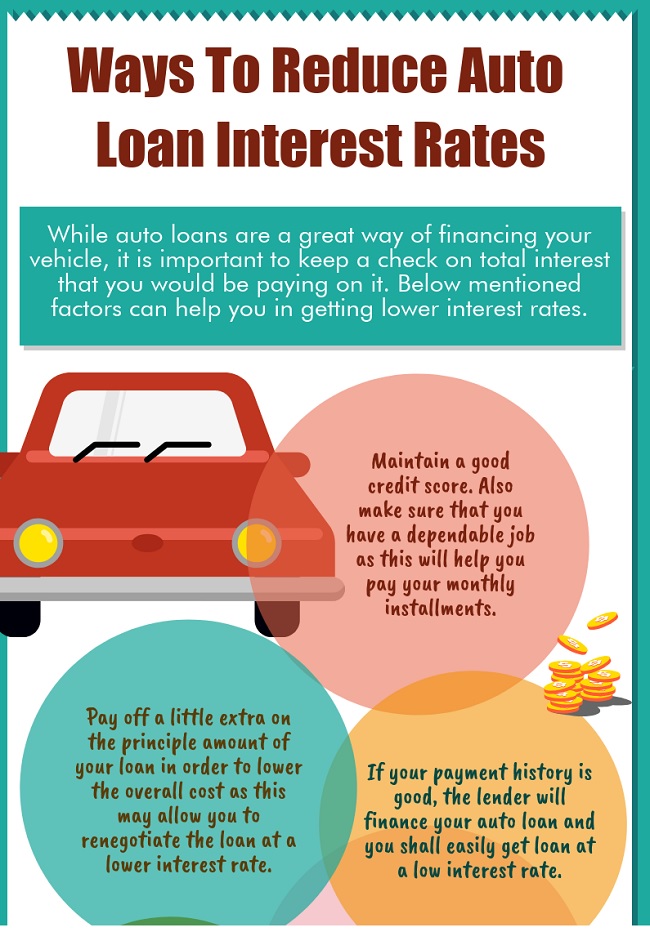

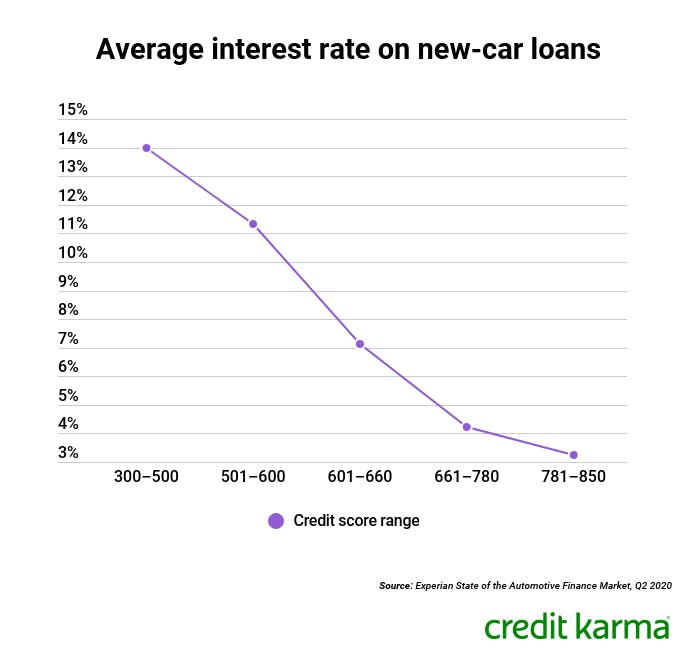

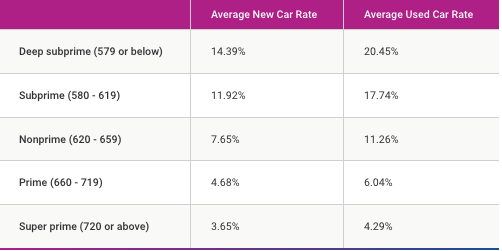

Once approved for funds, you’ll need to repay. Conversely, lower credit scores can mean offers of loans with higher interest. You can apply for low interest car loans through your bank, credit union, dealerships or online through a private lender.

The steps to getting a lower interest rate on auto loans are as follows: The most powerful factor affecting the interest rate. Making some lump sum payments lowers your loan balance and decreases the amount youre charged.

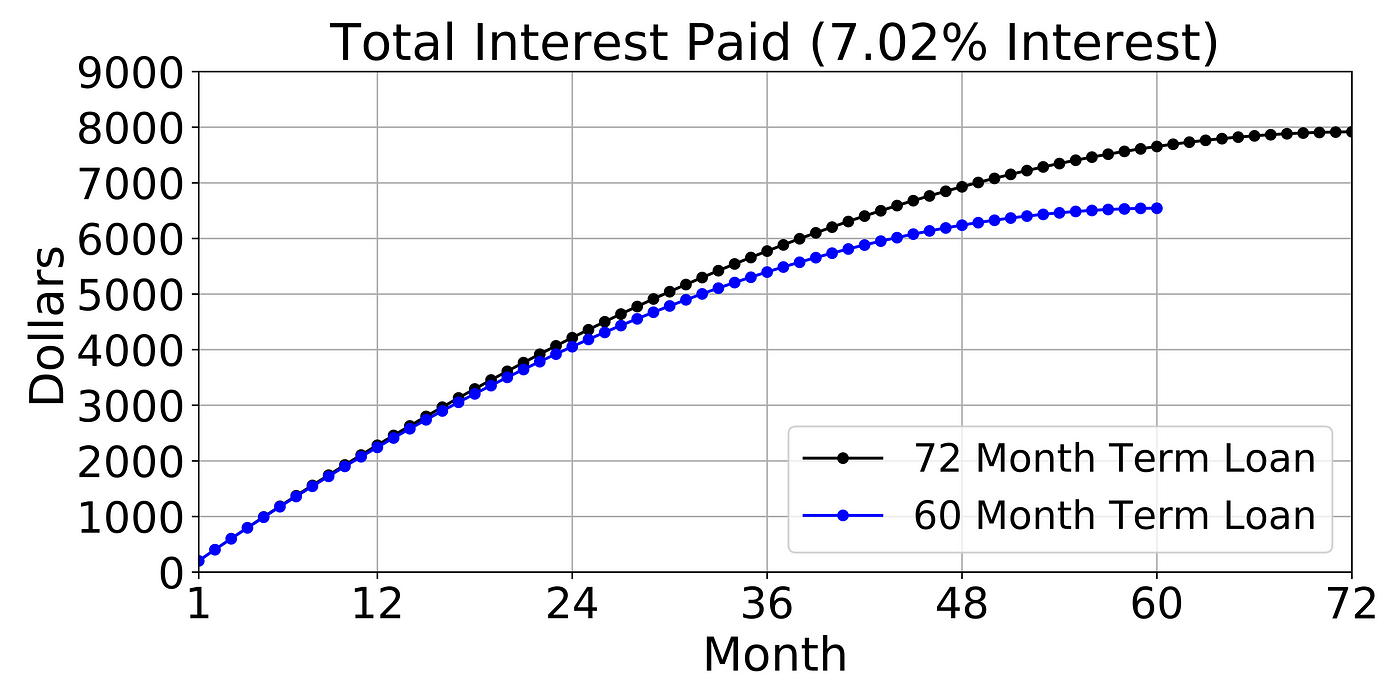

18 hours agowith high interest rates, your debt will continue to rise more quickly, making it harder to pay off. Auto loans have gone up along with car prices and interest rates. The faster you pay off the vehicle, the less interest youre charged.

:max_bytes(150000):strip_icc()/dotdash-070915-personal-loans-vs-car-loans-how-they-differ-v2-f8faff14abb1488d869f4026c406a86c.jpg)

![How Can I Lower My Car Loan Interest Rate? [6 Important Guidelines]](https://blog.way.com/wp-content/uploads/2022/03/Lower-APRs-for-refinance-scaled.jpg)

:max_bytes(150000):strip_icc()/pros-and-cons-of-refinancing-a-car-loan-1a117a027ee14bd583fd1abdef935b9d.gif)