Neat Info About How To Deal With Loan Sharks

1 day agoinstead of shutting them down completely, it would be better to open the banking system and regulate it.

How to deal with loan sharks. Loan sharks are quite successful since their services are very. She went to all the banks… and then eventually looked on gumtree where. Loan sharks charge between 5% and 20% per month.

Also, it is essential to make a parallel. You can report a loan shark online or call one of the following teams: Alternatives to loan sharks even in emergencies, it helps to contact licensed moneylenders for help as they are legitimate professionals.

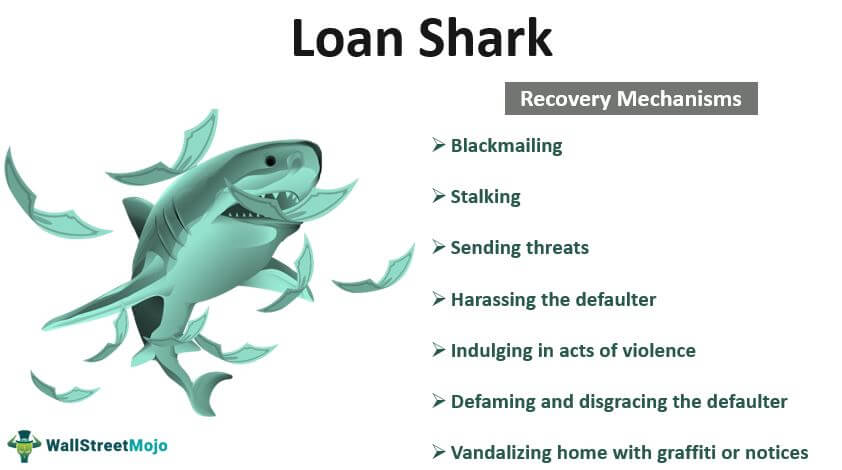

Avoid helping this type of lending proliferation. How do you deal with loan sharks? They can destroy your car, paint.

Don’t be a guarantor for someone else’s loan. Hence, if you see a moneylender violating laws and rules, it is likely a loan shark. This includes changing your phone number, social media accounts, and.

How to deal with loan sharks? Dealing with a loan shark takes some resilience, so if you fall prey and find yourself in the fangs of loan sharks, here’s what you have to do: You should also change any personal information that the loan sharks may have to avoid any further harassment.

Avoid such lenders at all costs, as they may. Remember that loan sharks do not abide by the rules of the government. They want their money monthly and i just.