Who Else Wants Info About How To Check Federal Tax Id Number

You will have to verbally answer the questions from form rc1.

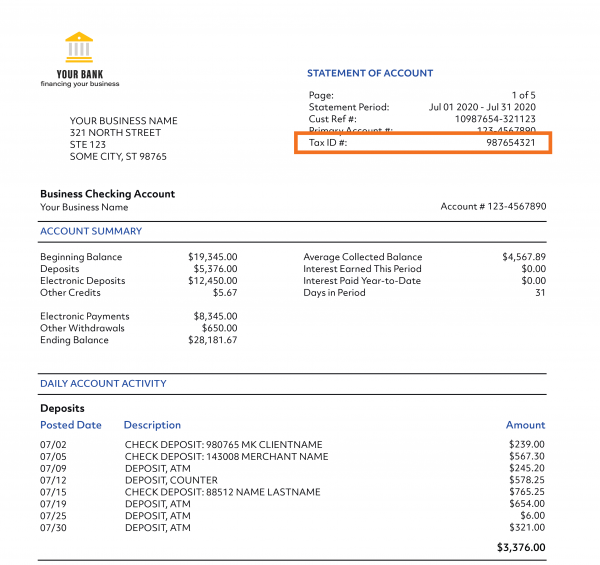

How to check federal tax id number. Once you have established your business, there are several ways you can check the tax id number status. As soon as you apply for an ein, you will receive notice that your ein application is complete. This has dispensed with the need for companies to apply for the issuance of tax.

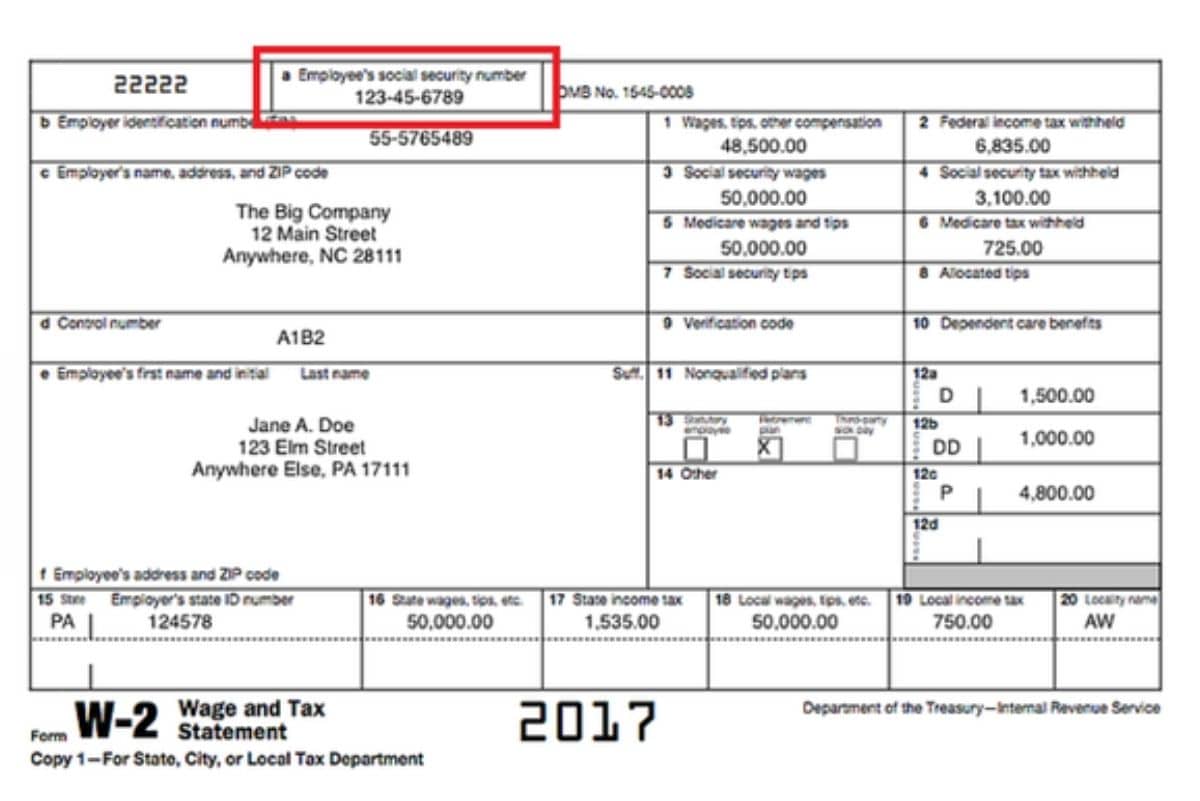

The hours of operation are 7:00 a.m. If you have a social security number, you will be able to use it as a tax id number. Check to see if you have any notifications from the irs , they will usually include.

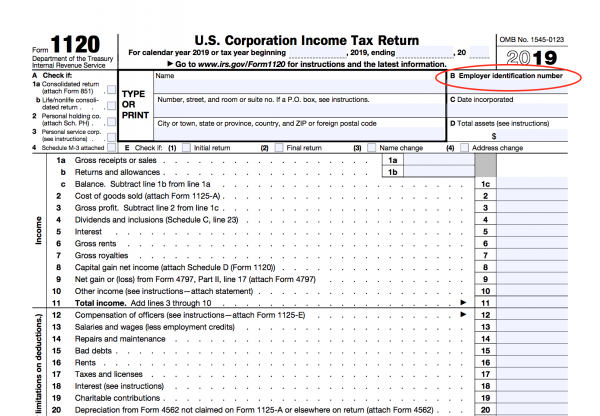

Electronic data gathering, analysis, and retrieval system (edgar) using the electronic data gathering, analysis, and retrieval (edgar) system is the easiest way to. Issued by the federal inland revenue service (firs) to such companies. Check your ein confirmation letter.

Your tin is most likely the business entity’s employer identification number (ein). You can also fill out a paper application. The easiest way to find your ein is to dig up your ein confirmation letter.

Use hipaaspace irs tin check service. This is the original document the irs issued when you first applied for. How to do an ein lookup online.

To verify an ein, it's necessary to register and pay a. You have a requirement to furnish a federal tax identification number or file a federal tax return, and; The best way to apply for your ein is to do it online.